Zakat Programme Notes (Hanafi)

Author | Speaker: Wifaqul Ulama SA Category: Course | Programme Notes, Fiqh | Jurisprudence Publisher: Wifaqul Ulama SA Share: More Detailsبِسْمِ اللهِ الرَّحْمٰنِ الرَّحِيْمِ

Allāh Ta’ālā has, in numerous places in the Qur’ān Karīm, emphasised the obligation of Zakāt.

“And establish Salāh and pay Zakāt and bow with those who bow [in worship and obedience]” (Ar-Rūm 39).

Nabī sallallāhu ‘alayhi wa sallam said: “Fortify your wealth by discharging Zakāt on it.” (At-Tabarāni).

Like Salāh has its specific times, rules, and regulations. Similarly, Zakāt also has its own laws and rulings.

The Zakat Programme Notes (Hanafi) prepared by Wifaqul Ulama South Africa includes the following:

-Zakāt vs Sadaqah.

-Who must pay Zakāt?

-Your Zakāt Date?

-Zakātable assets vs Non Zakātable assets.

-Calculating your Zakāt.

-Recipients of Zakāt.

-Tamlīk- A requirement for the validity of Zakāt.

-The Wakīl (Representative).

-Rectifying Zakāt of the past.

For ease of determining Nisab and calculation of Zakaat, refer to the Wifaqul Ulama Financial Indicators, which is updated daily as follows: https://wifaq.org.za/?page_id=21278

The Laws of Janaazah

The Laws of Janaazah  Ramadhaan – Fasting & Zakaah

Ramadhaan – Fasting & Zakaah  Marital Bliss

Marital Bliss  Spirit of Qurbaani

Spirit of Qurbaani  Spiritual Salaah

Spiritual Salaah  Law of Succession

Law of Succession  DUA’AS FOR GAZA AND THE UMMAH

DUA’AS FOR GAZA AND THE UMMAH  F. I. T. N. A+

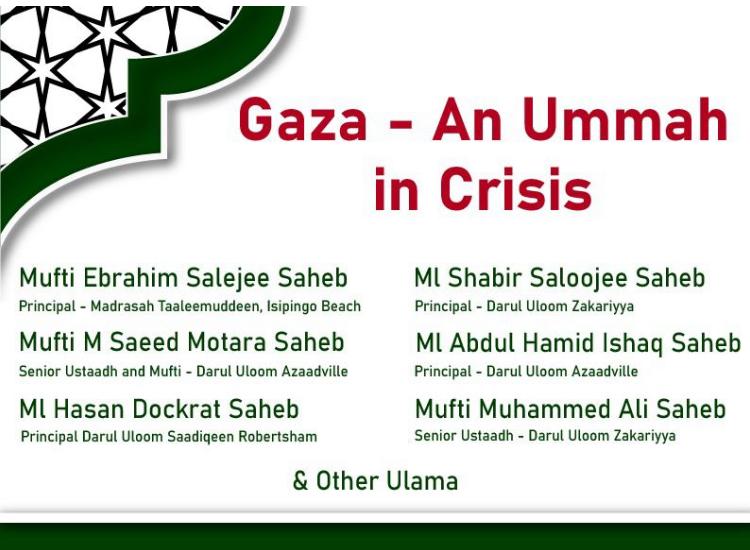

F. I. T. N. A+  Gaza – An Ummah in Crisis: Key Takeaways & Recordings (Benoni Programme)

Gaza – An Ummah in Crisis: Key Takeaways & Recordings (Benoni Programme)